Currency System Features

List of features and functionalities

- Login and Registration:

- Login: This refers to the process by which users access a system or application by providing valid credentials. Typically, users enter a unique username or email along with a password to verify their identity.

- Registration: This involves the creation of a new user account within the system. Users provide necessary information, such as a username, email, and password, to create an account. Registration is usually a one-time process.

- Multi-User Accounts:

- This feature implies that the system supports multiple user accounts. Each user account is unique and has its own set of permissions, settings, and data. Multi-user accounts are beneficial in scenarios where different individuals or entities need separate access to the system, each with their own level of authority.

- Informational Dashboard:

-

- An informational dashboard is a visual interface that provides a consolidated view of key information and metrics relevant to the system or application. It is designed to offer users a quick and easy way to grasp the current status or performance of the system. In the context of multi-user accounts, each user might see a dashboard personalized to their role or preferences.

- Elements on an informational dashboard could include charts, graphs, and summaries of data related to user activities, system status, or any other pertinent metrics.

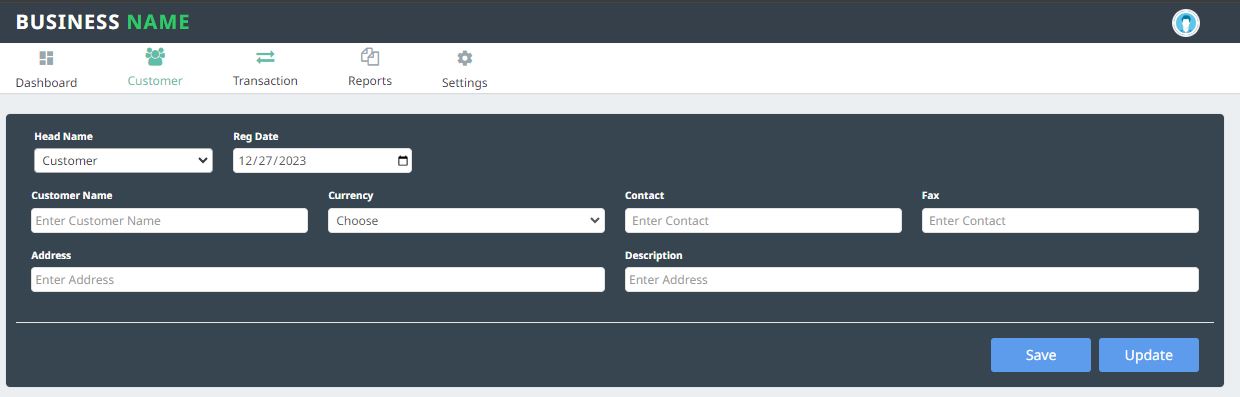

- Customers

Add New Customers:

This function allows you to input information and create profiles for new customers in your system. This is essential for keeping track of who your clients are and maintaining a database of their details.

Customer Currency Account:

This suggests a feature where you can associate a specific currency account with each customer. This is particularly useful if your business deals with international transactions or if customers have accounts in different currencies.

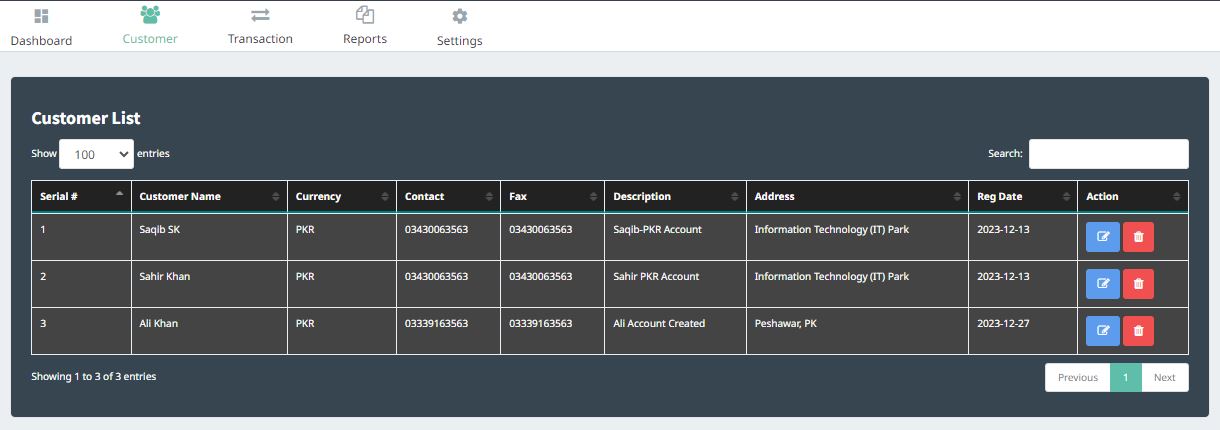

List of Customers:

This function provides a comprehensive list or overview of all the customers in your system. It’s a quick way to access and review the information about each customer in one place.

Edit / Delete Customers:

This functionality allows you to make changes or corrections to existing customer profiles (Edit) or remove customers from the system entirely (Delete). Editing is useful for updating information, while deleting might be necessary for managing outdated or irrelevant records.

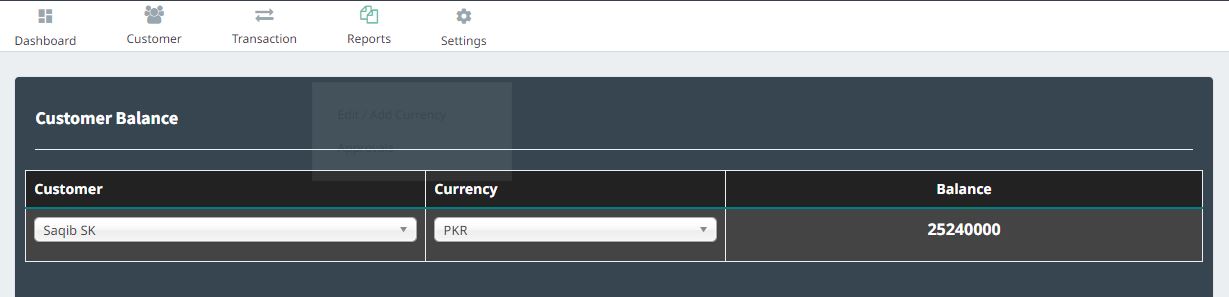

Customer Balance Check:

This feature enables you to review the financial status of each customer, specifically their account balance. It helps you monitor whether a customer owes money, has credit, or has a neutral balance.

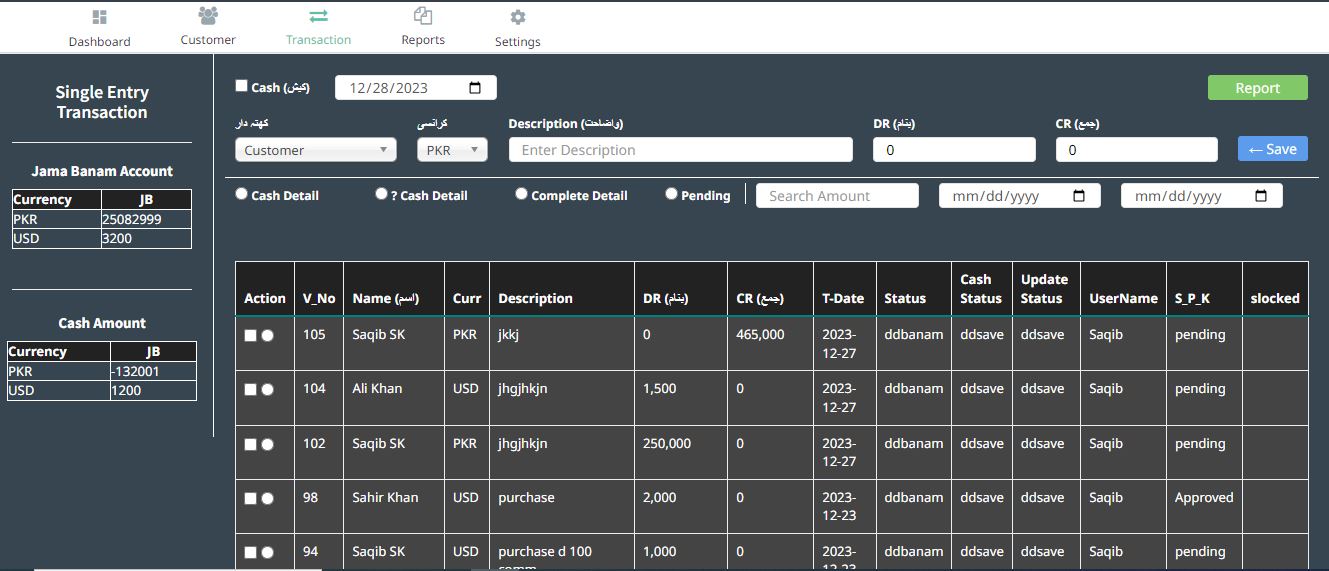

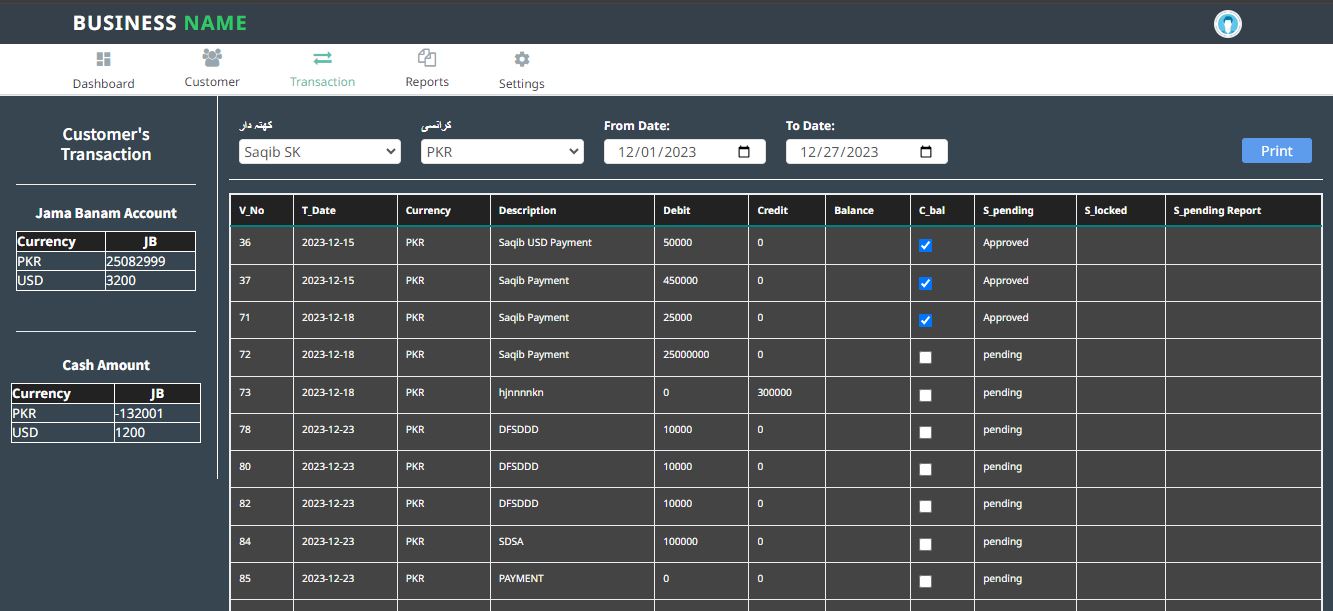

- Transactions

Single Entry Transaction:

In accounting, a single-entry system records only one entry for each transaction, typically the total amount. It is a simpler method, often used by small businesses or for personal accounting.

Double Entry Transaction:

In contrast to a single-entry system, double-entry accounting involves recording two entries for each transaction, known as debits and credits. This method is more comprehensive and is widely used in business accounting to maintain balance and accuracy.

Daily Transactions (Details):

This suggests a feature that provides a detailed breakdown of transactions on a daily basis. It allows users to review and analyze the financial activities that occurred on a specific day.

Edit / Delete and Update Transaction:

This functionality allows users to make changes to recorded transactions. They can edit details, delete entries if necessary, and update information to ensure accurate and up-to-date financial records.

Currency Conversion in Transaction:

This feature indicates the ability to handle transactions involving different currencies. It allows for automatic or manual conversion of amounts to a common currency, which is particularly useful for businesses involved in international trade.

Multi-Currency Accounts:

This suggests a system that supports accounts denominated in multiple currencies. It’s beneficial for businesses or individuals dealing with transactions in various currencies, as it simplifies financial management and reporting.

- Reports

Chart of Accounts:

The chart of accounts is a structured list that categorizes and organizes a company’s financial transactions. It includes various accounts such as assets, liabilities, equity, revenue, and expenses. Each account has a specific code or number for easy identification.

Debit / Credit Report:

This report summarizes the financial transactions of a business by categorizing them into debit and credit entries. Debits and credits are fundamental concepts in double-entry accounting, and this report helps in understanding the flow of money in and out of accounts.

Ledger Report:

A ledger report provides a detailed record of transactions for a specific account. It includes information about each transaction, such as the date, description, and amounts debited or credited. Ledgers are used to track the activity of individual accounts.

All Currency Ledger Report:

This report is an extension of the ledger report, but it specifically includes transactions from accounts denominated in multiple currencies. It provides a consolidated view of financial activities across different currencies.

Roznamcha Reports (Daily Transaction Report):

“Roznamcha” is an Urdu word that translates to daily diary or journal. The daily transaction report, in this context, likely refers to a summary report that outlines all financial transactions that occurred on a particular day. It helps in reviewing daily financial activities.

Daily Transaction Report:

This report is a broader term that encompasses all financial transactions that took place within a given day. It includes details such as transaction amounts, dates, and descriptions, providing a comprehensive overview of daily financial activities.

Profit & Loss Report:

Also known as an income statement, the profit and loss report summarizes a company’s revenues, costs, and expenses over a specific period. It helps assess the profitability of the business by showing whether it made a profit or incurred a loss.

- Add Currency:

This feature allows users to include or add new currencies to a system. It is useful in scenarios where transactions or financial activities involve multiple currencies. Adding a currency enables the system to recognize and process transactions in that specific currency.

- Transaction Approval:

Transaction approval refers to a process where designated individuals or authorities review and authorize financial transactions before they are finalized. This step ensures that transactions comply with established policies and guidelines before being recorded or executed.

All Currency Transactions Balance Dashboard Table:

This appears to describe a dashboard or table that provides an overview of transaction balances across all currencies. The term “all currency” indicates that the dashboard or table displays information related to financial transactions in various currencies. It could include details such as account balances, transaction amounts, and other relevant information.